Admiral Mike Mullen's Call to Action

Published on May 3, 2010Watch Admiral Mike Mullen, 17th chairman of the Joint Chiefs of Staff, call on communities here to support veterans as they transition from military service to civilian life.

Charitable Gift Annuities: A Highway, Not A Barrier to Planning

Published on Jun 14, 2019Thor Heyerdahl was an adventurer. After serving as a WWII parachutist, he worked as an anthropologist in South America. Discovering cultural, religious and oral history similarities between Polynesia and Peru led Heyerdahl to speculate on an ancestral connection between the two—an idea in direct opposition to the prevailing theory that the Polynesians were descended from other parts of Asia.

To prove that the ocean was a highway, not a barrier, Heyerdahl mounted an expedition to sail from Peru across the vast Pacific to the Polynesian Islands using a raft typical in material and construction to those used by the pre-Columbian Peruvians. He and five fellow adventurers loaded up Kon-Tiki (their 30 x 15 balsa-wood raft) and set off, reporting by radio on their status and scientific observations. Of course, this perilous 4,300-mile journey required extensive planning and courage, but the team proved the plausibility of Heyerdahl’s theory by reaching Polynesia in 101 days.

Today, philanthropically inclined adventurers may, like Heyerdahl, need assurance that a charitable gift can be “a highway, not a barrier” to income security. Donors who want to make charitable gifts but also want to be assured of future income security may find that a charitable gift annuity lets them do both—create a positive steady stream of income and accomplish another important goal in their philanthropic journey.

Formation: Considering Options and Planning Ahead

Short trips require planning, but longer voyages necessitate a greater investment of time and energy as travelers contend with alternate GPS routes, roadwork, flight schedules, tight connections, security measures, packing restrictions, and inevitable delays. Donors may confront a similar level of alternatives and challenges when setting up a charitable gift annuity (CGA).

Charitable gift annuities are contractual agreements under which a donor agrees to make an irrevocable gift of cash or property (often, long-term appreciated stock) to a qualified charity, and in return, the charity agrees to pay a fixed amount for life to the donor and/or another person designated by the donor, with payments to be made quarterly, semiannually or annually. However, the transaction is not merely a “quid pro quo” between donor and charity. Since the present value of the donor’s annuity is less than the value of the property transferred, the transfer is legally considered part charitable gift and part annuity purchase.

Note: Charitable gift annuities are regulated by state law, so advisors should review the applicable state requirements carefully.

Benefits of a CGA

Of course, the charity benefits from the gift, but there are a number of advantages to donors as well:

- Simplicity. Since a CGA is a contractual arrangement, it is often easier to create and explain than other charitable tools (consider charitable trusts, for example, which require additional legal work and expense to create and administer).

- Immediate tax deduction. The CGA provides an immediate income tax charitable deduction in the year the property is transferred to charity for donors who itemize.

- Income stream. The charity promises to provide annual payments over the lifetime(s) of one or two individuals, with part of each payment considered a tax-free return of principal—a promise backed by the charity’s general assets.

- Flexibility. The donor can choose whether to begin income payouts immediately or defer income until some point in the future.

- Appreciated property tax treatment. When a donor transfers appreciated property in exchange for a gift annuity, the resulting capital gains tax liability (recognized because the transfer is, in part, a taxable exchange of property) can be spread over life expectancy if the donor is the annuitant.

- Smaller gift threshold. Often, the minimum gift amount required is low enough to make gift annuities accessible to a large part of the charity’s donor base.

Types of CGA Agreements

There are typically three types of CGA agreements that fit the varying needs and wishes of the donor.

- Single life—an annuity that pays income to one person for that person’s lifetime.

- Two lives in succession—an annuity that pays first to one person and then, upon that person’s death, to a second person (assuming the second person survives the death of the first person).

- Joint and survivor—an annuity that pays two annuitants during their respective lives, but upon the death of one, pays the full amount of the payment to the surviving annuitant.

Usually, these agreements are fairly standard. They offer donors limited choices and are based on the type of CGA and what is permitted under state law.

Immediate vs Deferred

While an immediate gift annuity begins payments within one year, a deferred gift annuity lets donors postpone the start date of income payments beyond the one-year mark. A deferred annuity significantly increases the annuity amount and the income tax charitable deduction (which is still available in the year of the contribution). Although many high-earning donors find the immediate income tax relief attractive, they neither want nor need additional current income, preferring instead that payments begin later when they can be used to supplement other retirement income.

Funding the Gift

A donor may fund a CGA with cash or property. Though cash is the simplest option, using appreciated property (say, securities held for more than one year) lets donors avoid capital gains tax on the gift part of the CGA. In addition, the long-term capital gain realized on the annuity part of the CGA can be evenly spread across each year of the donor’s life expectancy.

Avoid funding a CGA with property that cannot be easily valued or sold. Payments for an immediate CGA must begin within a year, and the charity would be at a disadvantage if it could not quickly convert the funding asset into income-producing property.

The Gift Annuity Rate

Each charity determines its own annuity rate, but most charities adopt a rate similar to the schedule of rates published by the American Council on Gift Annuities (ACGA)—a nonprofit that has long published suggested maximum charitable gift annuity rates recognized as actuarially sound by state insurance departments and the IRS.

The Gift Amount

Each charity determines its own minimum amount necessary to establish a CGA. In many cases, this minimum is much lower than the threshold required for other charitable giving tools.

Long-Range Planning—For Fun and Financial Security

Though Thor Heyerdahl only took 101 days to cross the Pacific Ocean from Peru to Polynesia, experts warn that if you plan to visit Walt Disney World or Universal Studios in Orlando, you need to have resort rooms booked 365 days in advance, dining reservations made 180 days in advance, and ride reservations in place 60 days in advance. Despite the excessive planning that is necessary, millions of people eagerly plan visits, walking away at the end of their holiday with zero regrets and great memories of the vacation of a lifetime.

For donors, a little extra planning may provide them with the exact benefits they’d hoped for—a way to make a heartfelt gift to a favorite charity while securing a guaranteed income stream for life. In fact, when a donor understands this giving tool, makes wise choices when it comes to type and funding, and realizes how to avoid potential tax hazards, it’s easy to walk away with zero regrets. And while a charitable gift annuity may not make a donor vacation-of-a-lifetime happy, there can be true joy found in making a real difference to a meaningful charity while simultaneously securing future income and enjoying a current tax advantage.

[1] Thor Heyerdahl Biography (https://www.biography.com/people/thor-heyerdahl-21183589).

Value of Faith-Based Network for Veteran Transitioning

Published on Oct 2, 2014In communities across our country, local faith leaders find themselves on the front lines of helping our returning veterans with issues ranging from suicide and domestic violence to basic needs assistance. Spiritual wellness, along with emotional, physical, social and family wellness, makes up one of the National Guard's "Five Pillars of Wellness", which are seen as a roadmap to resiliency. Whether or not one connects with a religion, spiritual wellness means finding a sense of hope and belonging, and therefore not becoming isolated.

Over a three year period, the Lincoln Community Foundation has funded a faithbased organization that strives to bring all faith communities together in common spirit and purpose to work hand in hand within the county area. They organized their Second Annual Faith Community Disaster Preparedness Conference last month. Knowing that our veterans are hard-wired for service and volunteering, they have been working with the Southeast Nebraska Emergency Response Group to organize veterans to assist with follow-up services after disasters. In conjunction with the local disaster scenario they have identified 730 faith-based groups within Lancaster County and are compiling a Faith Community Directory as a resource that will identify which faith communities would be able to supply space for beds and kitchens for serving hot meals if needed.

They have initiated a "Vets to Vets" program in local churches to provide "safe places" for veterans to meet and share in a non-threatening environment. Some services have been provided to older vets, such as rides to appointments. The organization has sponsored a Traumatic Brain Injury and PTSD Treatment Training Seminar as well as partnered with a local addiction and mental health organization on a "Veterans in Transition" program. We know that transitioning back to civilian life is difficult for our men and women who have served in Iraq and Afghanistan. Yes, of course, they are in need of the social capital that helps them connect to educational and job opportunities, but the Lincoln Community Foundation feels it would be remiss to overlook the inestimable value of the relational network our faith communities can provide.

Sincerely,

Rob McMaster

Rob McMaster

Internal Operations Coordinator

Lincoln Community Foundation, Inc.

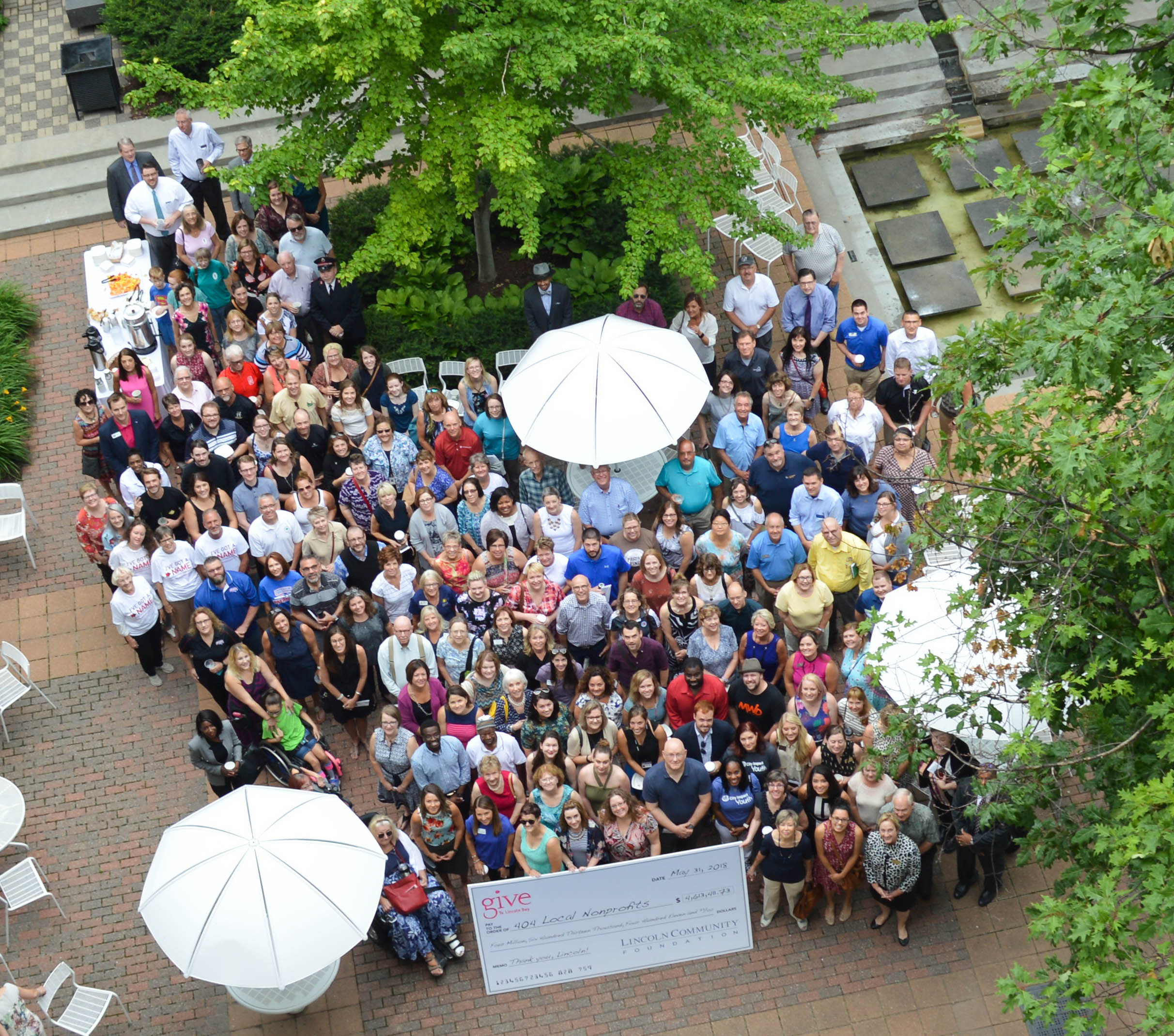

May 30 Give to Lincoln Day Stretches Donor Dollars

Published on Apr 26, 2019Record $450,000 in matching funds

Lincoln, Neb. – Lincoln’s 8th annual giving day is scheduled for Thursday, May 30. Organized by the Lincoln Community Foundation, Give to Lincoln Day is a 24-hour online event encouraging donations to support the local nonprofits and causes people care about.

Every participating nonprofit organization will receive a proportional share of the record $450,000 match fund, based upon its percentage of total dollars raised. Give to Lincoln Day 2019 will have the largest match fund in the event’s seven-year history thanks to a generous gift from West Gate Bank and several other supporting sponsors.

A record number of nonprofit organizations are participating in Give to Lincoln Day this year. A total of 439 local charities, including 51 who are participating for the first time, have registered.

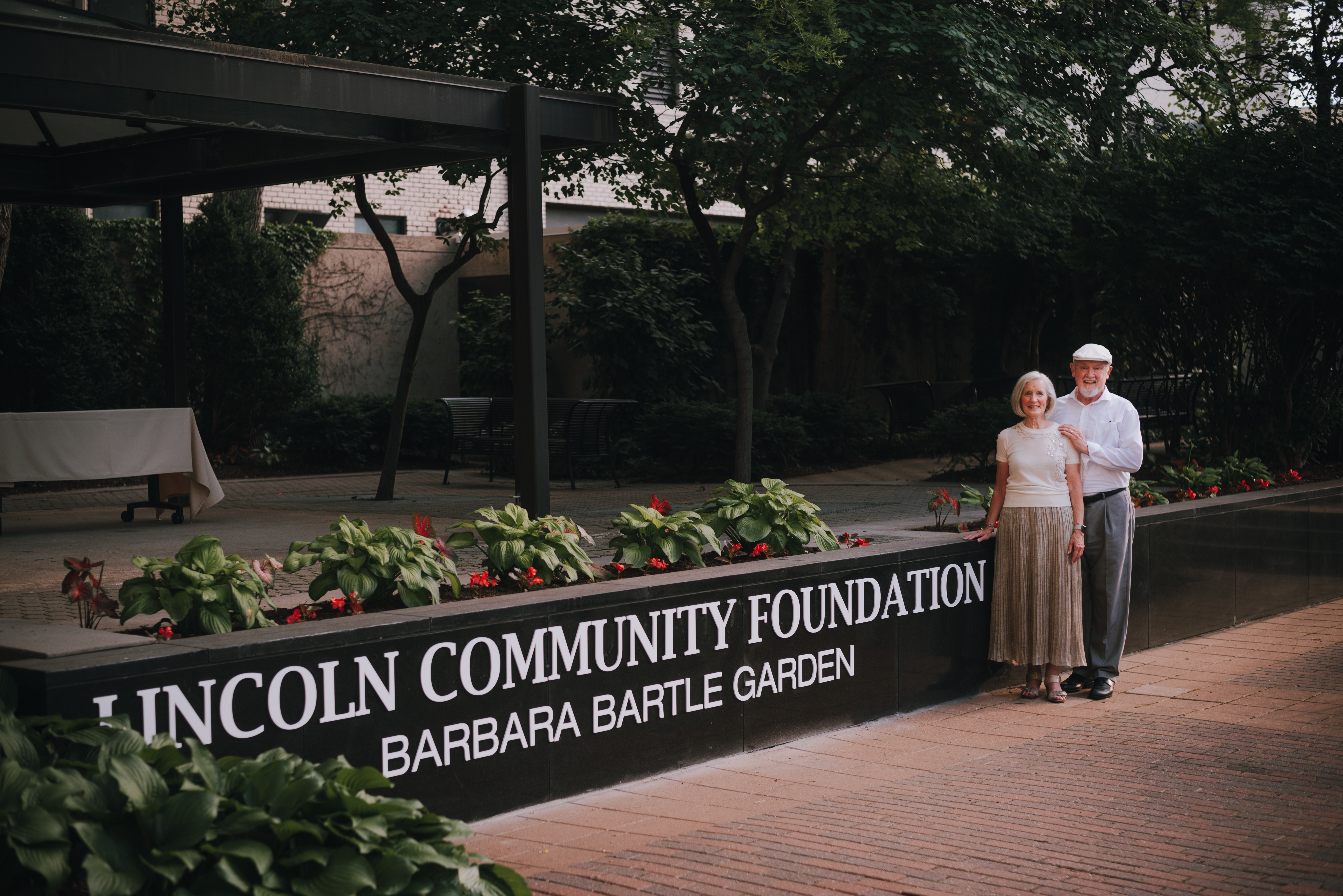

Last year’s event raised a record $4.6 million for 404 local nonprofits. “Lincoln’s generosity year after year is remarkable,” said Barbara Bartle, President of Lincoln Community Foundation. “Give to Lincoln Day has become a badge of honor for our community. It is a day when we come together to give our thanks and our gifts to the nonprofits for their tremendous impact in our city.”

The public is encouraged to visit Lincoln Community Foundation’s Tower Square at 13th & P Streets on May 30. Nearly 70 organizations will be there from 10 a.m. to 2 p.m. with hands-on activities, demonstrations and information about their programs. There will be a live performance at Noon by PANgea.

Donors may search nonprofits and give online at GiveToLincoln.com. Donors can plan ahead and begin giving online starting May 1 but all donations must be made before 11:59 p.m. on May 30 to count toward the giving day and the match fund. The minimum donation is $10 per charity. Donations will be charged to a credit or debit card.

Anyone who prefers not to give online can donate in person on May 30 only at one of three donations stations:

- Lincoln Community Foundation office, 215 Centennial Mall South, from 8:00am to 5:00pm

- Tower Square, 13th & P Streets, from 10:00am to 2:00pm

- West Gate Bank, 6003 Old Cheney Road, 9:00am to 4:00pm

On May 30, donation totals can be viewed throughout the day at GiveToLincoln.com.

The Lincoln Community Foundation, established in 1955, strives to continually enrich the Lincoln community by promoting and achieving perpetual philanthropic support. The foundation currently manages $127 million in assets and has distributed more than $130 million in grants to nonprofit organizations that have improved the lives of thousands of residents.

Give To Lincoln Day coming May 18

Published on May 5, 2017

This year, your gifts are even more powerful!

The sixth annual Give To Lincoln Day is coming up on Thursday, May 18 and is on pace to make the most impact so far. This 24-hour online event encourages donations to support the organizations and causes that people care about. . “We continue to hear from local nonprofits that Give to Lincoln Day serves an important role in increasing not just funding but also awareness of their causes,” said Barbara Bartle, President of Lincoln Community Foundation. “We are honored to host this event that so beautifully advances the culture of philanthropy in our great city.”

Biggest match fund yet! $350,000 to be shared with local nonprofits.

Local nonprofits participating in Give to Lincoln Day will benefit from a larger match pool to boost their donations. Each year since Lincoln Community Foundation started Give to Lincoln Day, the match pool has been a motivating factor for donors who want to make the most of their gifts. The match fund increases every donation, making each gift even more meaningful. Every nonprofit organization will receive a proportional share of the match fund, based upon their percentage of the total dollars raised for Give To Lincoln Day. We thank the generous local businesses and families who joined Lincoln Community Foundation in contributing to this fund.

New online fundraising platform designed by local business and local students.

Lincoln Community Foundation tries to use local vendors whenever possible but until now, there were no Lincoln-based online platforms for giving days. Lincoln-based technology company, Firespring, has been working with a student team from the Jeffrey S. Raikes School of Computer Science and Management at UNL to design a new online fundraising platform which will be introduced for 2017 Give To Lincoln Day. This unique collaboration between Firespring and Lincoln Community Foundation will reduce fees and result in nonprofits retaining more of each gift they receive.

Give Online at www.GiveToLincoln.com starting May 1

Gifts can be made online beginning May 1 and will qualify for Give To Lincoln Day and the match fund. On May 18, from 12 a.m. to 11:59 pm, these donations and all gifts made throughout the day will be shown in real time on the website leaderboard. The minimum donation is $10.

The Lincoln Community Foundation will also receive donations from people who prefer to make their gifts in person at the Foundation office between 8 am and 5 pm on May 18.

Fun in Tower Square

The public is encouraged to stop by Tower Square at 13th & P Street on Give to Lincoln Day between 10 am and 2 pm. Many of the participating nonprofits will be there with hands-on activities to enjoy and information about their causes.

Winter 2017 Newsletter

Published on Jan 26, 2017A grant sends Lincoln Police Department officers to Sex Trafficking Summit to bring back expertise that will help Lincoln fight the problem, Walter Canney creates fund to help veterans, Pumphrey scholarship has helped students for 36 years.

Download the newsletter to read more.

Winter/Spring 2019 Newsletter

Published on Apr 12, 2019To catch up on the latest Lincoln Community Foundation happenings click here to download the newsletter.

Survivors just want us to remember

Published on Jul 11, 2018Traveling slowly through Wyuka Cemetery’s winding roads, visitors will come across a giant triangular sculpture tucked into the northeast corner of the all-faith cemetery. The striking silver monument is dedicated to the memory of those who perished in the Holocaust and in honor of all the liberators and survivors of the Nazi concentration camps. The Nebraska Holocaust Memorial was created through the support of thoughtful Nebraska citizens with the intent to remember and educate on lessons of history.

Wyuka Cemetery is an ideal location for the memorial because it is the nation’s only state cemetery. “Nebraskans of all walks of life are buried at Wyuka,” said Gary Hill, volunteer Managing Director of the Nebraska Holocaust Memorial. “Governors, military, slaves, civil war soldiers, unmarked graves,” he said could be found here. “Black and white, rich and poor.”

Next to the large monument, visitors will find the Wall of Remembrance as well as the Children’s Butterfly Garden. A “sea of stones” surrounding the monument represent the millions of men, women and children who were systematically murdered by the Nazis and their collaborators. “There are an estimated 11 million stones,” Hill said. “While 6 million were Jews, many others – including gypsies, homosexuals and Catholics - were slaughtered in this government-sponsored genocide.”

Within the stone garden are bricks with the names of individuals with Nebraska ties who died in the holocaust. Visitors often place stones from the garden on the memorial, following the Jewish tradition of leaving a stone to indicate the loved one was not forgotten.

Lincoln Community Foundation is home to the Sam and Frances Fried Holocaust Memorial Maintenance Fund, which helps to preserve the memorial. “Our goal is to have enough endowment that money will never be an issue for volunteers in the future,” said Hill. He and a team of volunteers, along with the grounds staff at Wyuka, care for the memorial, ensuring that visitors who stop by from near and far have a personal and valuable experience.

The memorial, dedicated in 2007, receives no state funds. Schools from around the state visit the Memorial annually, and ongoing educational programming is a priority. Organizers are creating a new website that will allow students to trace family histories.

Individuals can support the ongoing educational improvements by donating $100 toward personalized bricks. Hill also hopes to adda brick to the butterfly garden with the name of every middle and high school in Nebraska.

Gary has become a Legacy Society member at LCF for his end of life gift that will contribute to the ongoing maintenance and improvement of the Memorial.

His advice to donors who want to leave their mark is, “Find what does good in the community.” Hill encourages others to consider leaving a portion of a family estate to the Lincoln Community Foundation with instructions indicating the causes or organizations you wish to support.

The memorial is considered one of Lincoln’s top 50 attractions by TripAdvisor.com. A visitor from Brooklyn, NY left a review on Trip Advisor, “It was so beautiful, so quiet, so well done that of course my tears just flowed.”

Tell us what is making a mark in Lincoln that you’d like to support. To find a way to make a lasting gift, contact Chip DeBuse, VP for Development, at 402-474 2345 or chipd@lcf.org.

Barbara Bartle Receives Community Impact Award

Published on May 5, 2017The Lincoln Independent Business Association presented the 2017 Community Impact Award to Lincoln Community Foundation President Barbara Bartle. This award is presented for being a “good steward” of the community and making Lincoln a much better place to live.

Lincoln Forever Brochure

Published on Mar 14, 2017The noble goal of the Foundation can most easily be captured in the two simple words that grace the cover of this brochure: LINCOLN FOREVER.

Give to Lincoln Day Raises Nearly $5.6 Million

Published on Jul 25, 2019

Give to Lincoln Day on May 30th raised a record-breaking $5,581,856, nearly $1 million more than the previous record set last year. The funds were designated to help support 438 local nonprofits that serve Lincoln and Lancaster County. All participating nonprofits will receive a proportional share of a $450,000 match fund provided by Lincoln Community Foundation, lead sponsor West Gate Bank, and other sponsors, based upon the organization’s percentage of the total dollars raised.

“Our generous community spirit continues to inspire me year after year,” said Barbara Bartle, President of the Lincoln Community Foundation. “The generosity of our community affects all aspects of Lincoln’s quality of life, including feeding the hungry, addressing physical and mental health, teaching skills for employment, giving children opportunity, and supporting pets, the arts, the environment and our parks.”

More than 21,000 individual donations were received for the 8th annual Give to Lincoln Day, an increase of almost 2,000 from the previous year. “Since Give to Lincoln Day began in 2012, donors have contributed more than $26 million to our nonprofits,” said Bartle. “Love was in the public square that day. We are so grateful to the caring Lincoln citizens on this remarkable day of giving.”

For more information and to see gifts received for each nonprofit, visit www.GiveToLincoln.com.

Do you want to play a BIG part in 2020’s Give to Lincoln Day? Learn how you can “love them all” by being a Match Fund Sponsor. Contact Tracy Edgerton, VP for Strategic Giving at 402-474-2345 or tracye@lcf.org.

Revocable Charitable Gifts: For On-Again/Off-Again Donor Relationships

Published on Aug 23, 2019On-again/off-again relationships can be fascinating to watch as long as you aren’t a part of the ride. Cheers, the award-winning TV show, featured one of the most celebrated on-again/off-again relationships between bartender Sam Malone and waitress Diane Chambers. Audiences laughed at their banter, identified with their romantic frustration, and shared their heartache—whether Sam left Diane or Diane left Sam. Over the years, Sam and Diane’s relationship cooled to make room for other characters and story arcs. Still, for viewers who lived with their own on-again/off-again relationships, Sam and Diane remained a cultural touchstone long after their storyline faded.

When we think about on-again/off-again relationships, we usually think about romance, but these relationships can also apply to charitable giving. Consider a donor who is passionately committed to making a gift to benefit a much-loved charity until, at some point in the future, something changes. When a donor makes a traditional, irrevocable gift, there is nothing the donor can do to alter the gift. However, when the donor makes a revocable gift, it is possible to change the gift to reflect the donor’s changing needs or objectives.

In this issue of CHARITABLE GIVING, we look at the process and challenges of revocable charitable gifts, including:

- •Bequests: The Traditional Way to Give

- •Revocable Trusts: An Effective and Flexible Planning Tool

- •Beneficiary Designations: An Easy Alternative

Bequests: The Traditional Way to Give

No celebrity couple exemplifies the on-again/off-again relationship better than Elizabeth Taylor and Richard Burton. The two met on the set of Cleopatra in the early 1960s and began a tempestuous romance that captivated the attention of paparazzi and fans around the globe. They were already married to others when they met, but both divorced their respective spouses so they could be together. In the years that followed, the couple married, divorced, remarried, and divorced again. With each divorce came rumors of reconciliation, and for good reason—Taylor and Burton seemed fated to be together and were drawn to each other until Burton died in 1984.

For donors who want the option to change their minds as often as Taylor and Burton did, there is no more “classic” revocable gift than a charitable bequest in a will. A will is the foundation of most estate plans—a legal document created by a testator under the laws of his or her state of residence.

A will primarily directs the distribution of the assets in the decedent’s estate. The testator uses a bequest to transfer specific property (money, stock, jewelry, artworks, and so on) to an individual or to charity. For many testators, a charitable bequest is a key component of their estate plan—a way to benefit a favorite cause or organization, honor an alma mater, or further the work of a religious institution.

The charitable bequest is a tremendous tool that provides donors with an easy, flexible way to make an impact by designating that one or more meaningful organizations or institutions receive:

- •A specified amount of money

- •A particular asset

- •A percentage of the value of the estate

- •The residue of the estate (in other words, those estate assets remaining after all other specific bequests, taxes, and expenses are paid)

A testator can include a bequest when the will is created or make a gift later by adding a codicil to the will. The testator can also invalidate the will simply by creating a new one, at which point the testator must decide whether to include the original bequest in the new will.

NOTE: It is usually beneficial for estate planning professionals to proactively ask clients about their charitable intentions as part of the will preparation process. Clients often focus on heirs and forget (or do not know) that they can include a charitable bequest. In addition, professionals can help testators avoid errors in bequest language and execution that can jeopardize an estate tax charitable deduction.

Revocable Trusts: An Effective and Flexible Planning Tool

If a will is considered the primary estate planning tool, a trust is not far behind. A trust is a legal entity under state law that holds property transferred by the grantor (the person who created the trust) and directs the distribution of property according to the grantor’s wishes. The grantor selects one or more trustees to manage the trust property for the benefit of the trust’s named beneficiaries. A trust provides the grantor with a degree of control that simply is not possible with a will.

The Five Basic Elements of a Trust

-

•Grantor—The individual who sets up the trust by transferring assets to a third party.

-

•Trustee—The individual, corporation, or bank that keeps legal title, possession, and control over the trust property.

-

•Trust Property—Otherwise known as the “corpus,” this may include anything capable of being legally owned, from real or personal property to a contract right (such as a life insurance policy).

-

•Beneficiaries—One or more named recipients of the trust income and corpus.

-

•Trust Terms—The instructions directing the trustee as to specific duties and distribution requirements.

A trust can be either revocable or irrevocable, depending on the terms of the trust agreement as determined by the grantor and as drafted by the grantor’s legal counsel.

-

•A revocable trust (also known as a living trust, revocable living trust, or inter vivos trust) is extremely flexible, allowing the grantor to make changes to trust terms or property or to revoke the trust entirely during life. The trust only becomes irrevocable at the grantor’s death.

-

•An irrevocable trust cannot be changed—at the time of creation, the grantor surrenders all ownership rights to the trust property.

The most prominent trusts used for charitable giving purposes are irrevocable (for example, charitable remainder trusts), but revocable trusts also provide giving options. A gift made through a revocable trust is like a bequest in a will—the grantor can modify or even remove the gift if circumstances change, but the gift becomes irrevocable at the grantor’s death. A charitable gift in a revocable trust requires the same diligence and care as a bequest, along with a similar level of additional documentation, follow-up, and communication.

Beneficiary Designations: An Easy Alternative

For donors who value flexibility, viewing revocable charitable gifts only in terms of estate planning documents would be a mistake. There is another easy, revocable option—naming the charity as the beneficiary of a life insurance policy or financial account. These gifts bypass the probate process and go directly to the charity, which typically means the charity receives a beneficiary gift much sooner than a gift made through a will.

A donor might consider using a beneficiary designation to make a gift with a:

- •Life insurance policy

- •Bank account

- •Brokerage account

- •Qualified retirement plan

- •IRA

- •401(k)

NOTE: There are good reasons for clients to use retirement assets to make a charitable gift, including a decreased tax burden on heirs. However, qualified plan owners must take care when naming a non-spouse beneficiary, as written spousal consent is often required under federal and/or state law.i

Using this type of revocable gift is a straightforward way to donate certain assets by simply designating the charity as the beneficiary on forms provided by the insurer, bank, or retirement account custodian. Donors must be sure to identify the charity using the organization’s proper name, address, and tax ID number. Like bequests and revocable trusts, a beneficiary designation is easy to update if the donor’s needs change.

Of course, donors should understand that the beneficiary designation controls the distribution of the policy or account, even in the face of conflicting distribution instructions found in the donor’s will or trust. Any instructions left in a will or trust regarding these items will have no effect if the asset is not left to the estate or the trust.ii

The Appeal of On-Again/Off-Again Relationships

Whether it is a fictional couple like Ross and Rachel from the TV show Friends, a real-life couple (or former couple) like Justin Beiber and Selena Gomez, or a sports star like LeBron James and his relationship to the city of Cleveland, most people understand the dynamics of on-again/off-again relationships. People involved in these relationships put up with the painful parts for many reasons, but first among them is often the potential for what might be.

This same sense of potential applies to revocable charitable gifts. Even though the donor may revoke the gift, most donors do not. In fact, revocable gifts are most often delivered as promised, fulfilling the donor’s desire to make a difference and providing a much-needed benefit to the charity. However, preserving the option to make a change, if necessary, relieves stress on donors who worry about an uncertain future.

Changing the Landscape from Nebraska to D.C.

Published on Nov 11, 2019

Donald Campbell believed he found the story of Nebraska when he discovered the story of Ponca Chief Standing Bear.

“His story is the story of our community, our state – ultimately a tale of sensitivity and kindness – capturing the essence of who we are and what we represent,” said Don.

Chief Standing Bear’s legacy so moved this Lincoln native – this philanthropist, lover and benefactor of the arts – he provided major funding to commission a world-class sculptor to create three dramatic 10-foot Standing Bear bronze castings, now poised on land stretching from Nebraska’s Niobrara River eastward to the Atlantic Ocean.

One statue stands grand and tall on the University of Nebraska-Lincoln’s edge of Centennial Mall, dedicated in October 2017. A second rests regally on a hill overlooking the Ponca tribe’s homeland near Niobrara. The final of the three – installed this fall – took its proud place in a prominent position within the National Statuary Hall at the U.S. Capitol in Washington, D.C., as one of two statues designated by the Nebraska State Senate.

These gorgeous works recognizing Standing Bear’s quintessential place in Nebraska history emerge from a unique partnership between Don, the City of Lincoln and the Nebraska Commission on Indian Affairs, with Don donating funds for the D.C. sculpture through the Lincoln Community Foundation and a qualified charitable distribution from his IRA.

Judi gaiashkibos, executive director of the Nebraska Commission on Indian Affairs, said Don’s gift has changed the landscape of Lincoln. “Don is a very kind and humble man who has a deep regard for history, and through his support of Standing Bear, is leaving a major legacy that will inspire others to do better. He is Standing Bear Strong,” said Judi.

She remembered how Don felt an immediate sense of compassion for this Ponca chief. “Don was so impressed with the dignity Standing Bear was able to maintain in the face of such shameful treatment. He agreed with me that the story of Standing Bear was a teachable moment in America’s history.”

Don has lived in San Francisco much of his professional life and was largely unaware of Standing Bear until he learned the narrative from Judi in their shared experience as Doane University Trustees.

“Judi had this dream to honor Standing Bear, and when she introduced me to his story – I knew something had to happen,” he remembered. “Here was a story of national importance, yet it had not been told … Here was a man who brought dignity to our Native Americans, and we had the opportunity to do something significant.”

Don helped commission renowned artist Ben Victor, whose ultimate sculpture captured the powerful image from 1879 when the Ponca tribal leader stood on trial, his right hand outstretched, fighting for the freedom to return to his homeland and bury his son.

The first two castings remain in Nebraska. The final piece arrived in the nation’s capital in September, a reality that happened thanks to Don’s unique gift to the Lincoln Community Foundation made possible with a qualified charitable distribution from his IRA (see sidebar).

“Lincoln is my home, Nebraska is my home, and it feels very good to have been part of this,” Don said. “This is a piece of Nebraska history, a piece of Native American history, that is an essential part of the nation’s history. We have not always done a good job of telling the story of Native Americans, and this is a wonderful chance to pass on that story to the future.”

USING IRAS FOR CHARITABLE GIFTS

Don Campbell made a qualified charitable distribution (QCD) from his IRA to a special fund at the Lincoln Community Foundation in order to bring the story and sculpture of Ponca Chief Standing Bear to Washington, D.C. this fall.

“When you reach a certain age, you must start taking money out of your IRA accounts,” Don explained. “But I discovered one viable alternative if you are in a position to give, where you can donate a limited amount of IRA funds to a charity. It counts toward the money you must take out but is not taxed. What a great way to give back to your community.”

If you are age 70½ or older and make a contribution directly from your IRA to a qualified charity, such as the Lincoln Community Foundation, you can donate up to $100,000 without it being considered a taxable distribution. For married couples, each spouse can make a qualified charitable distribution up to the $100,000 limit for a potential total of $200,000.

A QCD may offer tax advantages over a direct cash gift by the donor:

- • If the donor does not itemize deductions, a charitable gift made with cash will create no tax benefit. By contrast a QCD counts toward the donor’s Required Minimum Distribution but is not included in the donor’s adjusted gross income. The tax benefit is that a distribution from the IRA that would otherwise be taxable becomes non-taxable when it goes directly to charity.

- • The exclusion of the QCD amount from the donor’s adjusted gross income may also positively affect several other calculations such as the amount of social security benefits that are taxable and the cost of the donor’s Medicare premium.

For more information and examples of ways you can use an IRA contribution to achieve your charitable goals, contact Chip DeBuse at 402-474-2345 or chipd@lcf.org.

Strengthening the Community of the Future

Published on Nov 11, 2019 Twenty-five years ago, no one could have imagined a world with Google, gene therapy or smartphones. Yet-to-beimagined realities like these were one reason Pat and Ellen Beans decided to establish an unrestricted endowment at the Lincoln Community Foundation.

Twenty-five years ago, no one could have imagined a world with Google, gene therapy or smartphones. Yet-to-beimagined realities like these were one reason Pat and Ellen Beans decided to establish an unrestricted endowment at the Lincoln Community Foundation.

“We are placing our trust that the needs of tomorrow will be identified, and that our funds will help support the effort to address them,” said Ellen.

This commitment to community runs deep in the Beans.

“My mom and dad were great role models,” said Ellen. “They were very giving of themselves.” Ellen is in her 38th year with Bryan Health, where she oversees volunteering, patient experience and customer care.

“Bryan is a great example of a caring community,” she said. “It’s been a great journey for me, because health care and volunteerism are ever-changing.”

Pat, finance manager of Amandla LLC, began volunteering while attending Doane University and credits their sons Beau and Winston with strengthening his commitment to the community.

“There’s a lot we couldn’t have experienced or done if we didn’t have our kids,” he said. As a Meals on Wheels volunteer, he’d sometimes take Winston with him to make the deliveries. Ellen said they often took the boys whenever and wherever they volunteered. Those outings proved to be eye-opening experiences for the family.

“Volunteering for a non-profit really changed our journey,” said Pat. “By volunteering, you can see the needs of our community.” By making such efforts a family event, the Beans have helped pass along their community spirit to their sons.

“We have a firm belief in volunteering and have tried to raise our sons with that belief,” said Ellen.

With passions that range from health care to the arts, the Beans were drawn to the open-ended possibilities that come with an unrestricted endowment.

“While I’m alive, I have the option to be passionate about a project or need,” said Ellen. “After we’re gone, I hope our funds will be used in a way that reflects others’ passions and needs.”

Pat sees great potential in the flexibility that comes with the unrestricted endowment. “The needs of the community will change, but the need will always be there. By not being limited to a specific area, each year, those funds can go towards different needs,” he said. “This allows the Lincoln Community Foundation to put the money where that year’s greatest needs are.”

Ellen sees another advantage to this type of giving. “With the unrestricted endowment, those needs can be addressed sooner because the funding is already in place,” she said.

Pat believes that Lincoln is a better place today because of the impact of a previous generation’s endowments. “Today, we see funds being distributed from someone’s endowment that was set up years ago,” he said. “By setting up our endowment now, we have the chance to strengthen the community in the future.”

Ellen considers the unrestricted endowment to be an extension of volunteering and hopes that people see the validity of doing both.

“We can either choose to observe or to participate. We have to make that choice while we are living,” she said. “The endowment gives me a sense of peace, a way of making sure that the good continues.”

The Beans may not know what the future holds for Lincoln, but they do know that they can help make sure the community’s needs will continue to be addressed.

“We truly believe in this community and have placed our trust in the Lincoln Community Foundation,” said Ellen.

To learn more about establishing an unrestricted endowment at the Lincoln Community Foundation, contact Paula Metcalf at 402-474-2345 or paulam@lcf.org.

Charitable Giving eNews

Published on Aug 1, 2016Click on the following to download Charitable Giving eNewsletter:

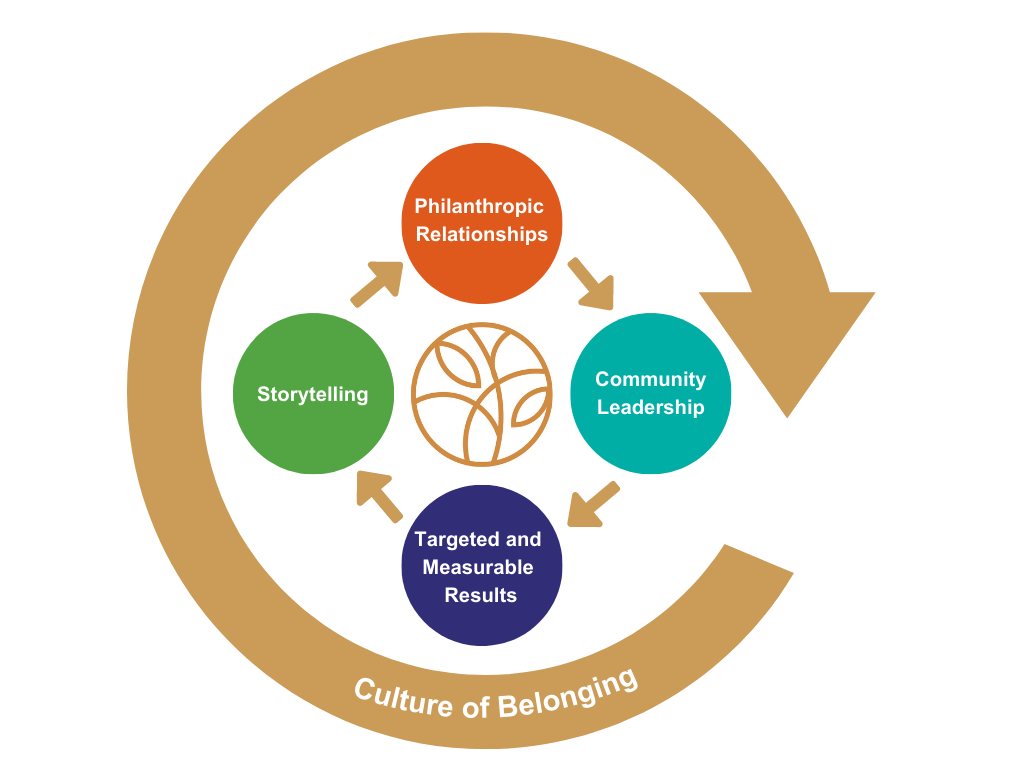

Turning Lincoln Vital Signs Data into Action

Published on Sep 21, 2022

Alec Gorynski, President, Lincoln Community Foundation

Originally published in the Lincoln Journal Star, September 21, 2022

Strong communities use data to make collective changes that ensure everyone has the opportunity to succeed and thrive. Since 2014, Lincoln’s data report – Lincoln Vital Signs – informs Lincoln residents about trends affecting our city and invites collaboration across our all sectors of our community to address its findings.

In 2014, a group of public and private organizations commissioned the first Lincoln Vital Signs report to educate ourselves about the socio-economic conditions of our community and inform funding decisions. Now in its fifth iteration, the recently published 2022 Lincoln Vital Signs report provides us with a shared understanding of our community strengths, persistent concerns, and overall population shifts.

This information is critically important as our community leaders continue to work toward our shared economic and social prosperity. Lincoln Vital Signs is actively informing organizations such as Lincoln Chamber of Commerce, United Way, Lincoln Community Foundation, and many other agencies as we work on the long-term needs and goals of our community.

The data from Lincoln Vital Signs inspires and shapes giving strategies of both individual donors and institutional foundations and is helping nonprofit organizations orient their programs toward clearly articulated needs. Lincoln Vital Signs also substantiates our Proser Lincoln community agenda, which continues facilitate collaborative efforts to address early childhood, affordable housing, strong neighborhoods, and an innovative workforce.

Overall, the recent report tells us that Lincoln continues to flourish in many ways. We have a high-quality workforce with low unemployment. Lincoln is a safe place to live, as evidenced by low property and violent crime rates compared to cities of a similar size.

We continue to become a more diverse community, with persons of color now making up 21% of our population. Poverty, homelessness, and food insecurity are all lower since the original Vital Signs report in 2014; and we saw a reduction in the number of census tracts experiencing extreme poverty.

Although many trends are moving in a positive direction, there are still some areas for concern. Per capita income adjusted for cost of living continues to trail the nation’s average, and this gap is increasing. The cost of early childhood education continues to rise, an issue of critical concern for working families.

Lincoln’s unemployment rate for racially minority populations is higher than Lincoln’s total unemployment and the poverty rate among black residents is more than double the rate for white residents.

General population shifts will shape future demand for services and programs. People moving into Lincoln have recently been driving our overall population growth, with half of those moving here being young adults 18 to 24 years of age. However, Lincoln’s overall population is aging, as our 65+ population has grown more than four times faster than any other age group in the past decade.

Local funders and institutions, in partnership with the University of Nebraska Public Policy Center, have continued to invest in and produce Vital Signs to ensure our community operates under a comprehensive and consistent set of metrics. I am grateful to our peer funders and the University of Nebraska Public Policy Center for making the Lincoln Vital Signs report possible.

For our community to become all we know it can be, we need to work together to do what we can to address the Lincoln Vital Signs findings. That means fewer people living in poverty. It means access to affordable housing and high-quality childcare and early education. It means a strong workforce and strong neighborhoods. It means together – we thrive.’

To view the full 2022 Lincoln Vital Signs Report, visit www.LincolnVitalSigns.org.

Donna Woods honored with Charity Award

Published on May 5, 2017The Lincoln Community Foundation is pleased to present Donna Woods with the 2017 Charity Award for her leadership and philanthropic work that has strengthened the Lincoln community. She will be recognized at the Foundation’s Charity Luncheon, our annual donor appreciation event and charity award presentation, on May 4.

Donna’s marriage to Chip Woods brought her into a family with a well-recognized practice of donating time and resources to the community. Donna shares that when she married Chip, she married into the Woods family’s charitable values and beliefs. Taking on this role was a natural fit. Donna’s philosophy is, “I believe you give back to the community that takes care of you. The Woods family firmly believed in this with Lincoln, due to its support of the Lincoln Telephone & Telegraph Company for nearly a century”. Donna went on to say, “People with resources have an obligation to donate money and time to charitable and civic causes.” Donna's generosity goes far beyond her significant personal financial support of the community. She has contributed countless hours to many organizations.

In Lincoln, Donna’s charitable involvement started with the Junior League in the early 1970s. Over the years she has served on a wide range of boards that include The Nebraska Cultural Endowment, Sheldon Advisory Board, Lincoln Children's Zoo, Museum of Nebraska Art, Nebraska Arts Council, Nebraska Art Association and Lincoln Symphony Orchestra. Her most recent commitment was serving as honorary co-chair for the successful fundraising effort of Woods Tennis Center’s capital campaign.

Art has always held a special place in Donna’s heart. She says “I think I’ve served on almost every art board there is in Lincoln, as well as many of the state organizations.” Chip's grandmother, Sarah Woods, was a significant patron of the arts and a big influence on Donna and her love for the arts. “Society thrives on the arts”, said Donna. Through 7 generations and more than a century, Woods family members helped Sheldon Museum of Art and the Nebraska Art Association acquire more than 180 works of art for their collection.

Donna joined Woods Charitable Fund board of directors in 2001 and has served as Board Chair since 2007. Woods Charitable Fund seeks diversity in the organizations who receive grants and the fund focuses on helping minorities and addressing tough issues in Lincoln. During her board tenure, WCF has paid grants totaling more than $22 million.

Donna and Chip passed their values along to their 3 children who are also very active and philanthropic. Donna is now teaching her 7 grandchildren to make charitable gifts. Each year she gives some funds to her grandchildren on the anniversary of the passing of her late husband, Chip Woods, and asks them to donate the money to a charity of their choice and for them to write her a postcard telling her where they gave and why.

Donna married Jon Hinrichs in 2002. As a retired physician, Jon is active in health care and also the arts. Jon and Donna enjoy sharing similar interests and a passion for using their skills and resources to make a difference.

Congratulations to Donna Woods, the 2017 Charity Award recipient. For information about the May 4 luncheon, call LCF at 402 474-2345 or visit www.lcf.org/charity.

Lincoln Community Foundation Awards $158,000 to Support 18 Local Nonprofits

Published on Feb 23, 2018The Lincoln Community Foundation distributed $158,000 in community grants to local nonprofit organizations. These grants are made possible by contributions from the Lincoln Forever Fund and from a number of LCF donor endowment funds. Organizations that received funding include:

Bright Lights - $10,000

Scholarship support for students in Title I Schools

Child Guidance Center - $10,000

Infrastructure upgrades and capital improvements

Clinic With a Heart - $10,000

General operating support

El Centro de las Americas - $9,000

General operating support

Junior Achievement of Lincoln - $5,000

Expansion of “It’s My Business” middle school curriculum

Legal Aid of Nebraska - $10,000

Capital improvements

Lincoln Literacy - $10,000

English Language and Literacy Academy

Lincoln Medical Education Partnership - $10,000

School Community Intervention & Prevention program

Lincoln Orchestra Association -$5,000

Social Impact Program and Family Literacy Partnership

Live Well. Go Fish - $10,000

Outdoor experience for seniors, youth, veterans and people with disabilities

Madonna Rehabilitation Hospital - $19,000

Community Medical Transportation program

Men with Dreams - $5,000

Program support to reduce juvenile recidivism rate

Nebraska Appleseed Center for Law - $10,000

Increase SNAP Employment & Training Program access

Nebraska Children and Families Foundation - $10,000

Learn and Earn to Achieve Potential (LEAP) program

Old Cheney Farmers’ Market - $5,000

SNAP and Double Up Food Bucks program support

Released and Restored - $10,000

General operating support

Salvation Army - $5,000

Shield Fine Arts Academy

Spring Creek Prairie Audubon Center - $5,000

Haines Branch Prairie Corridor

The Lincoln Community Foundation, established in 1955, strives to continually enrich the Lincoln community by promoting and achieving perpetual philanthropic support. The foundation currently manages $135 million in assets and has distributed more than $117 million in grants to nonprofit organizations that have improved the lives of thousands of residents.

Summer 2016 Newsletter

Published on May 1, 2016The fifth annual Give To Lincoln Day took place on May 26, and rasied $3,076,995 to help support 348 local nonprofits that serve Lincoln and Lancaster County. Local financial advisors explain why they recommend LCF funds to their clients.

To read more about Give To Lincoln Day and catch up on the latest Lincoln Community Foundation happenings click here to download the newsletter.

Give to Lincoln Day 2016 Totals by Nonprofits

Published on May 22, 2016Veteran's Support Initiative Editorial

Published on May 24, 2011SUPPORTING OUR VETERANS – A COMMUNITY RESPONSIBILITY

By Barbara Bartle, Lincoln Community Foundation

This week our nation takes time to remember the thousands of military men and women who made the ultimate sacrifice to protect our freedom. Memorial Day is a very somber and special day, filled with emotion and gratitude for the members of our armed forces. However, it is just one day. The reality is, serving in the military is a 24/7 job, raising the question – “What can we as citizens and communities do to support our troops throughout the year?”

The Lincoln Community Foundation was extremely fortunate to recently host someone with an answer. Colonel David Sutherland is a highly-decorated military soldier who now serves as special assistant to the chairman of the Joint Chiefs of Staff. The Colonel has been traveling the country as part of a 50 States in 50 Weeks campaign. He reconnects with men and women in uniform to see how they are doing, and meets with community leaders to discuss how every citizen can help returning service members and their families.

Colonel Sutherland knows first-hand how important this is, having suffered post-traumatic stress disorder following several tours of duty in Iraq. He reminded us that since 9/11 our military has been at war for 10 straight years. This affects not just active military troops, but tens of thousands of National Guard and Reservists called to active duty multiple times.

He said the signature wounds of Iraq and Afghanistan are post-traumatic stress or traumatic brain injuries, which often manifest themselves in unexpected ways. Many families struggle to return to what would be considered a “normal home life.” Communities must help develop meaningful and holistic connections for service members to achieve effective reintegration into civilian society. Addressing the epidemic of disconnectedness requires the creation of significant human connections. Both peer-to-peer and mentorship relationships can be critical models for successfully creating long-lasting and meaningful connections.

While government programs are tasked with meeting the needs of current and former service members, government agencies cannot and should not be the only answer. For many veterans of combat the best treatment is understanding and support within their local communities. And that is where all of us can play an important role.

Colonel Sutherland spent most of the day talking with religious, civic and not-for-profit leaders, sharing a number of great ideas on what Lincoln area organizations and residents can do to help veterans and their families. Community-based strategies should focus on providing access to education, meaningful employment, physical and mental health care and reintegration skills. Participants were asked to think about what the community could be doing in terms of communication, collaboration and coordination to help meet these needs.

Colonel Sutherland noted that many challenges for veterans can be due to, or exacerbated by, policyrelated barriers at multiple levels and sectors. But when action is initiated at the local level by citizens committed to making a difference, community-based programs can be identified and created quickly to help veterans become positive, contributing members of society.

To honor Colonel Sutherland’s visit, the Lincoln Community Foundation established a new Military Support Fund. Grants will be made to not-for-profit organizations in the community to support areas of unmet need for our service members, veterans and their families such as counseling, physical and mental health services, employment and education opportunities.

It is our hope that citizens in Lincoln and throughout our state agree that we can and should do more for our service members and military families. There is immeasurable potential for returning soldiers to become productive leaders and contributors to our state. Veterans of the Iraq and Afghanistan conflicts live in dozens of Nebraska communities, and I encourage local civic leaders to come together, ask how you can help, and then take action. Together we will build a Nebraska legacy, our promise to our service members, veterans and their families.

How can you help? Employ a veteran. “Adopt” a military family in your neighborhood, church or school. Make a gift to the new Military Support Fund or create one in your community.

For more information contact the Lincoln Community Foundation, 402-474-2345 or www.lcf.org.

Turning Memories Into Gifts Doing Good

Published on Jul 25, 2019

A third generation Lincolnite, Marcia Wallen knew she wanted to thank the community where she and her children were raised. “Lincoln has been good for our family and I want to give something back,” she said.

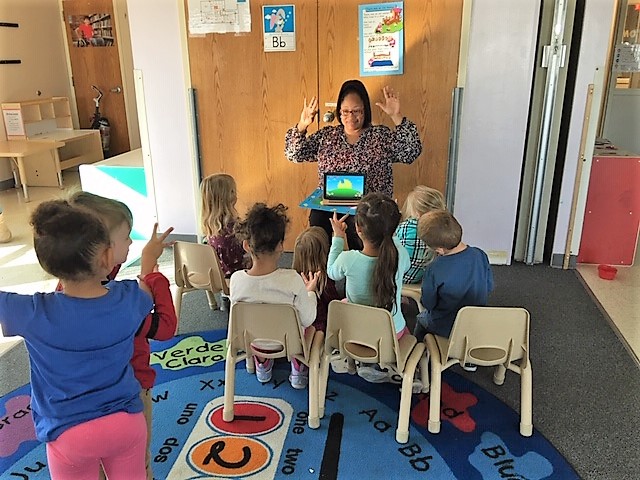

Marcia’s father Simon Kominsky owned an appliance store in Havelock and mother Estelle worked in preschool settings. Marcia had a long career as a dietitian, working for more than 20 years at Family Service of Lincoln’s WIC program, which provides nutrition information and food to low-income women and their children. Even in retirement, she works part-time at Lincoln Children’s Zoo in membership and reception.

“My career put me in touch with nonprofits,” she said. “It allowed me to see so much good in Lincoln.”

When her father passed away in December, 2017, a few years after her mother passed, Marcia and her brother Jordan Kominsky wanted to do something to honor them.

They designated a part of their parents’ estate and created a fund at Lincoln Community Foundation designated for South Street Temple where their parents worshiped.

Marcia was inspired with the idea when she heard Chip DeBuse, LCF’s Vice President for Development, speak at an event about different ways people can give through the Foundation.

She had planned to leave much of her own estate to Lincoln Community Foundation. “My family is taken care of and BJ has passed away,” she said, referring to her late son who suffered from mental health and substance use disorders. “I wanted to help others.”

“BJ always was his own person. He lived life by his own rules,” she said. “Addiction was a demon that was stronger than he was.” He passed away on April 14, 2015, nine days short of turning 35.

Since that time, Marcia had wanted to honor him and help others. She had planned to fund two Field of Interest funds through her own estate. One would honor her mother by funding early childhood education initiatives and another in honor of BJ that would fund substance use disorders.

Through discussions with her financial advisor at Edward Jones, Jenna Vitosh, Marcia learned she could use a portion of the Individual Retirement Account (IRA) she inherited from her father in a way that would fulfill her charitable wishes now, by funding the Field of Interest funds she had planned. “This is a great option for people like Marcia who are very charitable,” said Vitosh.

“I’m so glad I will get to see the funds helping somebody,” Marcia said. “If I can save one person, it is worth it.”

“Marcia is probably one of the sweetest, most kind-hearted people I’ve met,” said Vitosh. “I admire her desire to give back and honor the people that matter to her.”

Would you like to use an IRA to make your charitable wishes come true? Learn how by speaking to your tax or financial advisor and contacting Paula Metcalf, VP for Gift Planning at 402-474-2345 or paulam@lcf.org.

Partnering Up to Prevent Homelessness

Published on Apr 26, 2021

Collaboration is key in the City of Lincoln – especially during these challenging times. Agencies and non-profits regularly join forces to achieve amazing things. Sometimes the relationships come together at the right moment to form something much larger than anyone could imagine.

That was the case with the Lincoln Prevention Assistance Common Fund (LPAC). LPAC is a partnership between the City of Lincoln Urban Development Department, UNL Center on Children, Families, and the Law (CCFL), and the Lincoln Community Foundation. The partnership formed to distribute funds to Lincoln residents from the Coronavirus Aid, Relief and Economic Security (CARES) Act.

The local economy has been impacted by the pandemic in many ways: job reductions and furloughs, business closings, employees forced to leave the workforce to care for children no longer in schools and daycares. The ripple-effect through the workforce made it clear that if actions were not taken soon, people would be at risk of homelessness, many for the first time in their lives.

Lincoln is familiar with issues surrounding homelessness and has been working aggressively to create solutions as well as develop affordable housing. The Center for Children Families and the Law (CCFL) has been identifying and assessing the most vulnerable among the City’s homeless population through their coordinated entry system, called All Doors Lead Home (ADLH). This system provides people and families experiencing homelessness multiple public and private access points in the City to be assessed for housing assistance.

Public access points include Center Pointe, Matt Talbot Kitchen and Outreach, Family Service, People’s City Mission, The Hub, CEDARS and Community Action Partnership of Lancaster and Saunders Counties. Any person or family experiencing homelessness in Lincoln can visit these public access points to be assessed and referred by the coordinated entry staff.

ADLH has been addressing the needs of individuals experiencing homelessness in Lincoln for the past four years, however the assessment of individuals and families at risk of becoming homeless, known simply as prevention, is a new component of the coordinated entry system.

“Prevention was going to be a piece of All Doors Lead Home,” says Denise Packard, the Coordinated Entry Manager for CCFL. “We were already planning to go live with prevention and coordinated entry, however the pandemic made us do it in double-time.”

The City already had a strong working relationship with CCFL, due to their involvement with the continuum of care in the Lincoln Homeless Coalition. It made sense for the City to partner with CCFL on CARES Act funding because of their existing relationship and framework for assessing homelessness.

“When we found out we would be receiving these funds, it seemed like a good fit,” said Wynn Hjermstad, the Community Development Manager in the City’s Urban Development Department.

The next step was bringing in an organization to manage the multiple streams of funding. Much of the funding came in the form of CARES Response and Recovery funds through Nebraska Department of Health and Human Services. Other funds came from Emergency Solutions Grants and Community Development Block Grants. Each of these funding sources have different eligibility requirements that needed to be adhered to. Having multiple agencies manage the different funds would involve significant overhead.

That’s when the Lincoln Community Foundation stepped in.

LCF and the City’s Urban Development Department had already been working together to address Prosper Lincoln’s community agenda focus area of Affordable Housing. The pieces were now in place: homeless management, prevention, and continuum of care are now centralized through ADLH, and flowing through one payment processor, LCF.

Getting the program off the ground was not an easy task. CCFL only had months to create a prevention process to integrate in the existing coordinated entry system. LCF had to pivot employee time and resources to process the payments.

“We were building the plane while we were flying it,” said Michelle Paulk, Vice President Community Outreach at LCF.

That plane was the vehicle that helped many Lincolnites navigate through turbulence. Since July, more than $2.5M in rent, mortgage and utility assistance has been distributed to more than 850 households, many who received assistance are families with children.

“I learned we can do so many different things,” said Michelle. “The Foundation can be helpful to the community by being that neutral convener, that neutral place that can distribute funds and make a big impact on folks who need rapid assistance.”

“I always knew our community is pretty darn awesome, but this solidifies it for me,” said Denise. “Our partnership with the City and the Foundation has been wonderful. It makes me realize you can move mountains when you put your mind to it.”

Bansals’ Hearts Belong to Lincoln

Published on Mar 5, 2020

As they celebrate the golden anniversary of their arrival in Lincoln (following a few years in Lawrence, Kansas) as a young couple from India with three small children, Mahendra and Prem Bansal determined to honor their family legacy of generosity with a heartfelt gift to the Lincoln Community Foundation.

“Giving back to the community was part of our growing up, our faith, our family values,” Mahendra explained. “Our parents told us that you should always give whatever you have. The amount doesn’t matter, it is only important to give. Like our parents, we believe in leaving the world a better place than we found it.”

The principle of philanthropy was cultivated on both sides of their families. Prem’s parents gave to orphanages, while Mahendra’s family donated their land in India to create a school that eventually transformed into a college. “When people were looking for jobs, they would regularly come to our home in Delhi and stay with us,” Mahendra said. “A person never went hungry when they were in our house.”

Preeta Bansal, their youngest daughter and an LCF board member, reflected on this philosophy of care that shaped her family. “My parents come from a culture where family is everything, and community is family. They both were born into large families at a time when community and family were the primary source for safety nets, so extended family members looked after one another. And villagers and community members were all considered part of the extended family.”

To honor that family tradition of giving, and as part of a larger community charitable giving strategy, the Bansals created a charitable gift annuity at the Foundation, which offers a lifetime income for Mahendra and Prem now while providing future support for the community. As a result of this gift, they are new members of the Foundation’s Legacy Society, honoring donors who arrange now for a gift at the end of life. “This is about giving back to Lincoln, a place we love,” Prem said. “Lincoln is our home. We want to pass on the blessings this community has bestowed upon us.”

The Bansals grew up in India, married and had three children, but both wanted to further their education. Mahendra came to America first to earn his doctorate in Kansas. Prem and the children followed soon after, and a job opportunity for Mahendra brought them to Lincoln. It has been a wondrous journey. Mahendra became a registered professional engineer with a Ph.D. in civil engineering, and he led the Data Bank for the Nebraska State Natural Resources Commission for decades. Prem has a Ph.D. in public administration and was the first Indian American woman to serve in a professional role in the Nebraska statehouse.

Throughout her tenure as a public servant, Prem worked with five Nebraska governors over three decades as senior aide, policy researcher, policy advisor and division head.

Their children also flourished.

• Ameeta Martin was in second grade when they arrived in Nebraska. She’s now a pediatric cardiologist in Lincoln.

• Jay became a cornea and refractive eye surgeon and lives as an entrepreneur in California.

• Preeta graduated from Harvard Law School and has spent more than 30 years in senior roles in government, global business and corporate law, including positions at the White House and U.S. Supreme Court. She recently returned to make Lincoln her home.

“Now that I’m back here in Lincoln and get to see them up close and personal, I am amazed how active my parents remain, socially and civically,” Preeta said, noting a dizzying landscape of hands-on community service that includes Heartland Big Brothers and Sisters, Matt Talbot Kitchen, Cedars Home for Children, Friends of Foreign Students, Downtown Rotary, the Hindu Temple and the Faith Coalition of Lancaster County.

Granddaughter Alyssa Martin, a policy aide for Lincoln Mayor Leirion Gaylor-Baird and also a Harvard Law School graduate, agrees. “My grandparents infused in all of us a love for service to others and for seeing past surface differences, to honor unity as well as the unique humanity and spark of the divine in each person,” she said.

The Bansals are thankful for their blessings. “We believe in demonstrating gratitude and making a fair contribution. It is so easy to procrastinate, so we wanted to do something now,” Prem said. “Our fifty-year anniversary in Lincoln seemed like the right time to say thank you to a community that has been very good to us. Our hearts belong to Lincoln.”

Leave Your Mark on the Future

When Mahendra and Prem Bansal decided it was time to do something now to create a future charitable legacy, they turned to the Lincoln Community Foundation. The Bansals met with Paula Metcalf to brainstorm about how best to structure a future gift, and after considerable discussion they elected to create a charitable gift annuity as an initial step in their community giving plans.

Members of the Foundation’s Legacy Society make the ultimate and honored gift by including the community alongside family in the distribution of their assets through a will or trust, via beneficiary designation on a retirement account or insurance policy, or by creating a charitable gift annuity.

Mahendra and Prem were drawn to the Lincoln Community Foundation because it is a trusted organization, centered on community causes.

Their advice to Lincoln citizens: make your plans now. “Please do not put off your giving,” said Prem. “As we grow older, it becomes even more important to give back to our community.”

To learn more about how to create a charitable legacy, contact Tracy Edgerton at 402-474-2345 or tracye@lcf.org.

LCF celebrates 60th Anniversary

Published on Jan 1, 2015The words LINCOLN FOREVER convey the fondness that those who have made gifts to and through the Foundation have always held for this community.

The Lincoln Community Foundation celebrates our diamond anniversary, 60 years of service to Lincoln, in 2015. For sixty years, we have been privileged to be part of so many wonderful legacies by matching community needs with the passions of our donors.

As our anniversary gift to Lincoln, we are focused on building a new group of Diamond Donors. These new donors, with a love for Lincoln, will help continue to move the vision of Lincoln Forever forward.

Click here to download our 60th Anniversary Brochure and find out how you can be a Diamond Donor.

Spring 2016 Newsletter

Published on Apr 1, 2016The Lincoln Community Foundation is pleased to present Jim and Mary Abel, and the Abel family, with the 2016 Charity Award for three generations of leadership and philanthropic work in Lincoln and throughout the state.

Download the newsletter to read more about the Abel family and meet our newest benefactors.

Fall 2016 Newsletter

Published on Aug 1, 2016Since the Prosper Lincoln Community Agenda was launched last February, an infrastructure of professionals and organizations has been put in place to guide the work. The meetings are starting conversations, bringing people together to support each other, creating energy and breaking down silos. Jeff Johnson shares why he loves the LCF Donor Advised Fund.

Click here to read the Fall 2016 newsletter and what Lincoln Community Foundation is doing to take Lincoln to the next level.

2016 Annual Report

Published on May 3, 2017Spring 2017 Newsletter

Published on May 9, 2017To catch up on the latest Lincoln Community Foundation happenings click here to download the newsletter.

LCF Selected for Pioneering Disaster Preparedness, Response and Recovery Program

Published on Jun 16, 2016|

FOR IMMEDIATE RELEASE |

Pam Hunzeker Lincoln Community Foundation |

|

June 16, 2014 |

402.450.1519 |

Lincoln Community Foundation Selected for

Pioneering Disaster Preparedness, Response, and Recovery Program

Lincoln, NE — When disaster strikes, community foundations like Lincoln Community Foundation are often called into action to help residents connect to emergency services, accept donations and engage in community rebuilding. To become an even better partner during these extreme conditions, Lincoln Community Foundation has been selected to participate in a new disaster-preparedness, response, and recovery program designed to help community foundations expand their ability to respond quickly, efficiently, and effectively to natural disasters.

Philanthropic Preparedness, Resiliency, and Emergency Partnership (PPREP) selected 18 community foundations from across the Midwest. The two-year program will offer selected community foundations the resources, learning, and best practices they need to prepare for a natural disaster. The program is managed by the Funders’ Network for Smart Growth and Livable Communities and includes a grant to support the disaster preparedness of each selected foundation.

“Being chosen to participate in the PPREP program will be extremely helpful to Lincoln and Lancaster County,” said Barbara Bartle, president of Lincoln Community Foundation. “The associated grant is bringing additional financial resources to our community and complementing current disaster relief planning. We will work with Volunteer Partners to develop and execute our plan so we are better prepared to respond should the need arise.”

The unique attributes of community foundations are well suited for disaster work, including the ability to bring together service providers, community based organizations, businesses, government, and others, as well as their capacity to efficiently pool and distribute funds from donors. The PPREP program is designed to support foundations and equip them with tools and knowledge they need to serve their communities when an immediate, effective, and coordinated response is of the utmost importance.

About Lincoln Community Foundation

The Lincoln Community Foundation, established in 1955, strives to continually enrich the Lincoln community by promoting and achieving perpetual philanthropic support. The Foundation has distributed more than $75 million in grants to nonprofit agencies and organizations that have improved the lives of thousands of residents.

Lincoln Community Foundation Awards $135,000 to Support Veterans & Families

Published on Dec 1, 2010Council on Foundations Idea Lab Grant $17,500 December 2010

The Lincoln Community Foundation was awarded a grant to develop a model for community foundation intervention to address immediate needs and do develop a network of public and private organizations with the capacity to serve those who served our nation in Operation Enduring Freedom and Operation Iraqi Freedom. The participating community foundations on this project included: California Community Foundation, Community Foundation in Jacksonville, Dade Community Foundation, Dallas Foundation, Gulf Coast Community Foundation, Lincoln Community foundation and San Antonio Area Foundation.

Center for Rural Affairs $15,000/2010; $3,500/2011

This Nebraska based organization works to establish strong rural communities, social and economic justice, environmental stewardship, and genuine opportunity for all while engaging people in decisions that affect the quality of their lives and the future of their communities. They are currently working closely with the national Farmer Veteran Coalition to support veterans who want to become farmers and ranchers, by providing resources, training, technical assistance and access to land – all barriers to getting into farming.

CenterPointe, Inc. $10,000 February 2011

This is a facility for treatment, rehabilitation, and housing for women, men and teens overcoming homelessness, mental illness and addiction. They launched a new program in partnership with the Veterans Administration to provide 10 men who are veterans, homeless and mentally ill with transitional housing, life-skills education and counseling services.

The Bryan LGH Independence Center $40,000 February 2012

Bryan LGH is constructing a new facility. The current facility serves those seeking substance abuse treatment and mental health treatment for Lincoln, Nebraska and the surrounding region. Referrals from Fort Riley and Offutt Air Force Base continue to increase, last year 87 active military patients were treated at Bryan LGH, many for prescription drug addiction, posttraumatic stress disorder and depression. Bryan LGH Behavioral Health is unique as it is one of the few facilities in the country able to effectively treat people with co-occurring illness; patients with both mental health and substance abuse needs.

Survivor Outreach Services $12,000 February 2012

Host a retreat for thirty Nebraska Gold Star Families, specifically those who have lost loved ones in military service to the United States. This would mark the 1st annual retreat for Survivors of military deaths from all branches and components of the military and is intended to honor and remember the military members who have died while serving. This retreat will demonstrate continued support to the Gold Star Families in Lincoln, Nebraska and the surrounding area, by providing tools and skills to increase their resiliency.

Interchurch Ministries/Association of Ministries $15,000 November 2011

The faith community plays a critical role in the area of human services in Lincoln. The Lincoln Interfaith Council dissolved several years ago and this created a void in the Lincoln Community in the area of communication and networking within faith-based organizations. The Interchurch Ministries is creating a new Association of Ministries that will re-establish this critical organization within our community. This council will be an important factor in assisting and serving our returning veterans. Leaders of faith communities are in a unique position to help identify issues that effect this special population and can help facilitate solutions. The establishment of a strong Association of Ministries will strengthen the community’s efforts to help our returning veterans and their families as they return to civilian life.

Veterans Freedom Music Festival $5,000 June 2012 2012